Investment

Investment Models

1) Very early stage high-risk high-return start-ups needing preliminary POC funding typically in the region of USD 250,000 to USD 600,000 for about 10-25% founder equity.

2) Early stage but with some robust POC validations that provide a compelling business case typically needing USD 1.5-8.0 million to take it to either a pre-IPO status or a pre-commercialization status for about 15-30% equity.

3) Mid-stage with many robust POCs that answer most risk mitigations and merely involve upscale investment or facilities construction that are regulatory-compliant. These face less risks and uncertainty. These are typically seeking USD 8-15 million for anywhere from 20-35% equity.

Obviously, these are all generalizations and we are aware that biotech deal structures are very varied and there are literally no hard and fast rules so long as there is a compelling but practically executable business case.

Investment Companies

Our portfolio includes a diverse array of investable companies, each with strong potential for growth and profitability. By investing in our portfolio of companies, we provide an opportunity for investors to participate in the growth and success of some of the most exciting and innovative companies in the market today. With our rigorous research and analysis, investors can feel confident that their investments are in good hands, and that they have the potential to see strong returns over the long term.

In very special cases, we can also consider investment within our Holding Company Lybica Ventures Sdn. Bhd. as well but this is an exception we can make for very special investors.

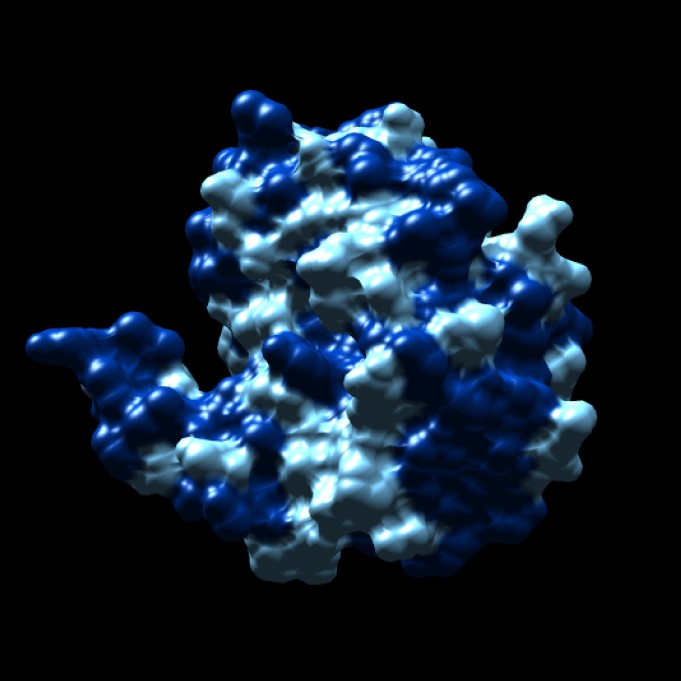

This is Lybica’s investment in cutting edge bioprocess technology. New IP in protein refolding, bioreactor design, recombinant protein expression and target protein purification will allow strategic disruption in the manufacture of E. coli expressed biologics. Both in vitro and in vivo evidence has been evaluated for the efficacy of target proteins. Engagement with a KOL has confirmed this is a potential game changer in the reduction of CAPEX, OPEX and COG (cost of goods) and has a potentially high strategic and economic value. Upscale POC (proof of concept) at 300L-800L capacity will be evaluated by 2026.

This is a JV between IBX and investment from the Middle East in the field of Equine Health. Al Khuyul is “the horse” in Arabic and the focus is developing antiviral injectables, nasally delivered interferons as well as orally administered nutrigenomic methyl donors for histone modifications. Of particular interest is the treatment of Equine Herpes Virus 1 (EHV-1) that can cause abortions of high value pedigree racehorse foetuses. After we achieve our initial POC in treating EHV-1, we shall also explore the development of Induced Pluripotent Stem Cells (IPSC) for use in treating racehorse injuries.

Viroxcell is focused on treating viral and bacterial infections as well as cancer in companion animals. However, there is also a focus in the application of endolysins to treat dangerous antibiotic-resistant bacteria such as MRSA (Methicillin Resistant Staphylococcus aureus). This is a major cause of concern in hospitals where long term ICU patients, especially those who are immunocompromised, get infected by MRSA. The beauty of the synergy between IBX and Viroxcell is that upscale production technologies for endolysin production can be done among sister companies within Lybica Group.

Ambrosian focuses on the use of cutting-edge technology to utilize the emerging science of nutrigenomics for improving health as well as biological age. The use of various methods of assessment of cellular age using biological clocks will allow long term monitoring of how successful nutrigenomic interventions are in addressing areas of specific concerns. Another case of synergy between sister investments is that the IPSC technology for use in racehorses will come from Ambrosian where Yamanaka Factors will be used for this exciting technology to change old senescent cells into young ones again.

Femdora is somewhat different from the other investments as it does not involve molecular biology. Nevertheless, a KOL who is an advisor to the UK government has said this innovation is very impressive. After 4 years of research and investment by Lybica, a personal lubricant made up of GRAS ingredients has shown ability to kill sexually transmitted viruses, bacteria and yeasts by 3-4 log units without harm to symbiotic Lactobacilli that preserve vaginal pH. Animal trials have shown promising results, and the next financing round will take this to Health Canada Regulatory Compliance leading to a human trial using microbiome analytics to validate its efficacy in improving human vaginal health.

Chief Scientist’s Message

We wish to address specific issues that affect all of humanity. Things like sexual pleasure. Like not getting pregnant for some; wanting to get pregnant for others! Staying healthy. Like staying youthful; like not going blind. Like not becoming another statistic in the next global pandemic. Not dying a miserable and painful death from cancer. Also, very important, to have more economical ways of manufacturing better and safer medicines leading to cheaper medicines.

With the advent of AI and powerful computing capacity, as well as the knowledge accumulated in many key areas of the life sciences, what used to sound like science fiction is today much closer to reality than you think. Many ideas can be turned into a working hypothesis and validated by rigorous experimentation. Join us on our exciting journey to market-relevant discovery!

Ung Eng Huan

Co- Founder’s Message

Being friends for almost two decades, I understand exactly how my co-founder works. In the last 4 years after starting Lybica Ventures together with him as equal partners, I have gained much more confidence that he is capable of getting teams of scientists to produce the type of technology disruptors and experimental evidence that is necessary.

As Director of Business Strategy, I believe my partner and I have the necessary complementary strengths and of course, certain expertise that are lacking may always be outsourced.

Tan Jee Tien

After almost 2 decades of hiatus, Huan & I finally caught up during the Covid-19 Pandemic in mid-2020. I was perplexed by this global pandemic & Huan was able to explain this scientifically from his years of experience and knowledge

of viruses.

I was impressed with his partnership with the Industrial Innovation Center of the Sultanate of Oman and I decided to be his Angel Investor to commercialize the XC-19 product (Food Grade Covid-19 Disinfectant). However, later as the science of this epidemic was better understood, we realized that the mode of transmission didn’t warrant the urgency of the use of XC-19 Food Disinfectant. We could have sold this product with some marketing hype but we decided to be true to the scientific facts instead.

Fortuitously during the Covid 19 pandemic lockdown, Huan & his team serendipitously stumbled upon a few other applications of our knowledge obtained during our foray of the XC-19. As they explored more deeply & with the liberty of unrestrained latitude, they discovered more potential applications while improving their bio-processing of proteins, and we can now say “the rest

is history’.

Lybica Ventures is now our holding company that invests in the other exciting start-ups we are involved where our tech-platforms can be patentable, cause the most disruption and meet market needs in a fast-changing world.

Tan Jee Tien